While the doubling of additional buyer’s stamp duty (ABSD) to 60 per cent for foreigners may deter some investors from purchasing Singapore properties, it may not turn away those who are serious about relocating here or who are setting up family offices, said experts.

Some may choose to rent instead of buy homes when they relocate.

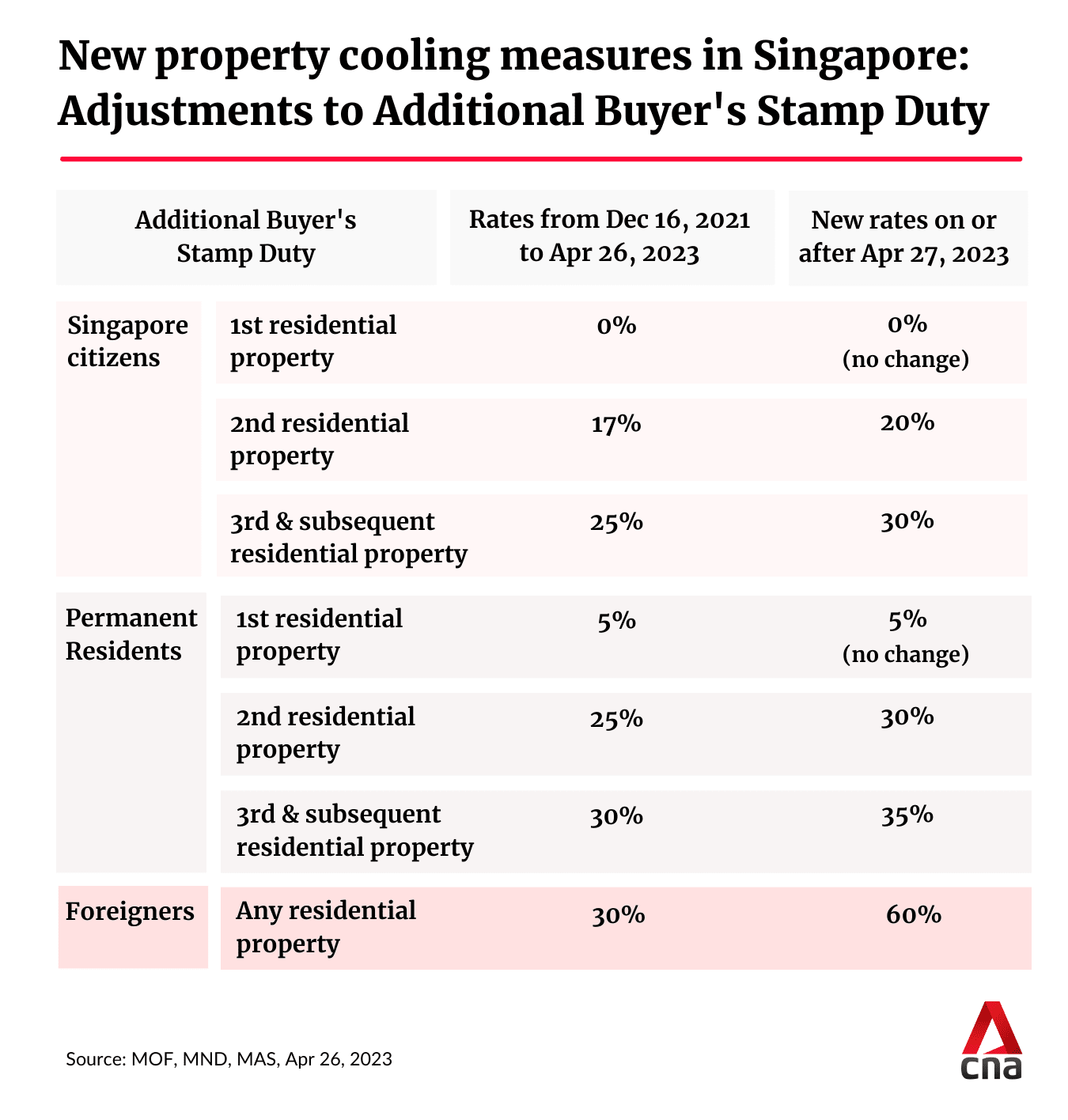

The cooling measures took effect on Thursday (Apr 27). It is the second time the ABSD has increased in the last two years – going from 20 per cent to 30 per cent in December 2021, before doubling to 60 per cent now.

The ABSD rate also went up to 65 per cent for entities or trusts purchasing any residential property, except for housing developers.

Meanwhile, Singaporeans pay no ABSD on their first property and 20 per cent on their second. Permanent residents pay 5 per cent on their first home and 30 per cent for the second.

The increase in ABSD for foreigners is “very significant”, said Mr Loh Kia Meng, co-head of private wealth and family office practices at Dentons Rodyk.

“I am sure that it will impact investor sentiment on the property market,” he added.

However, there are a variety of reasons why foreigners buy properties here, which affects how they view the ABSD rate, said Mr Alan Cheong, executive director of research & consultancy at Savills.

“When they park their money here, it is more like I want to diversify out of my country to a safe haven and some may say that I need to have a holiday home here, or I need to send my kids here to study,” he added.

Mr Loh said that foreign high-net-worth individuals may consider renting first, applying for permanent residency, and then buying a property after that to get much lower ABSD rates.

Mr Leo Kwek, a real estate investment consultant at AnjiaSG, which specialises in helping Chinese clients buy property in Singapore, agreed that it will not affect potential immigrants’ decision to move to Singapore as they will look to obtain PR before purchasing a property.

He foresees that more foreigners will choose to rent instead of buying.

“Most of the clients setting up new family offices in recent years are from Asia and Asians typically like to own the properties they stay in. This may well change now with the large ABSD hike,” said Dentons Rodyk’s Mr Loh.

Minister for National Development Desmond Lee said on Thursday that the ABSD hike is a pre-emptive measure to dampen local and foreign investment demand in Singapore’s property market.

When asked why the increase was much higher for foreigners than that for Singaporeans and PRs, he said that the ABSD adjustments for Singaporeans and PRs “should suffice” to dampen local investment.

“But when you talk about foreign investment demand, you’re talking about really … people who see Singapore residential property as an attractive investment class. Therefore, we’ve had to calibrate the ABSD rate in order to have an effective dampener on investments from abroad,” said Mr Lee.

The Ministry of National Development has said that the ABSD rate increases will affect about 10 per cent of residential property transactions, based on 2022 data. Of these, about 5 percentage points are Singaporeans or PRs buying second or subsequent properties, foreigners make up about four in 10 and the remaining 1 percentage point are entities.